The Macro Case for ETA in ANZ: What 3 Charts Tell Us About the Next Decade

If you joined the ETA Forum in Sydney or grabbed coffee with anyone in the search fund space in Sydney or Melbourne lately, you’ve likely felt it. The ecosystem is waking up. There are more searchers launching, more lenders getting comfortable with the model, and more capital circling the space than there was even two years ago.

But vibes aren’t an investment thesis. To understand why this market is attractive right now, we have to look past the anecdotal buzz and examine the structural wave forming beneath the surface.

The core thesis for search has always been simple. There are more sellers than buyers in the lower end of the market. This dynamic creates an opportunity to acquire high-quality businesses at reasonable multiples and incentivises talented people to opt out of the traditional corporate ladder or the high-risk startup lottery to become small business operators.

In Australia and New Zealand, this dynamic is an emerging reality.

I want to focus on three specific charts from the recent 2025 ETA Forum that strip away the noise and lay bare the mechanics of this market. These charts don't just show growth. They reveal a potential dislocation between the supply of retiring owners and the scarcity of sophisticated buyers. They explain why the high-quality operator is a viable succession solution for a massive segment of the economy.

Let’s look at the data.

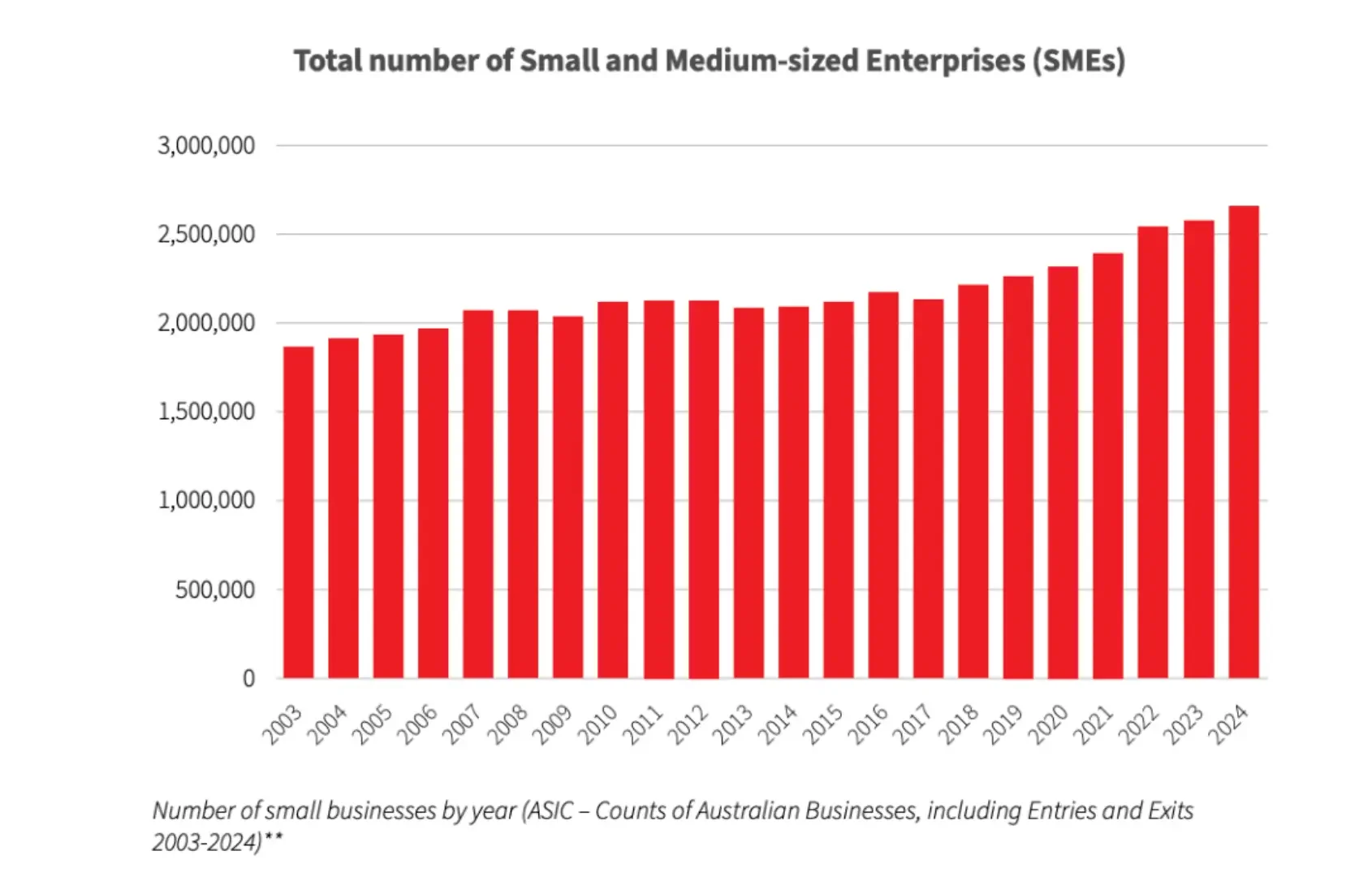

Chart 1: The Pool is Getting Deeper

The first chart we need to internalise is arguably the most fundamental which is the raw volume of opportunities.

Searchers often fear scarcity of opportunity. They worry they are embarking on a journey to find a needle in a haystack. The ASIC data tells a different story. The pool of targets has expanded through every major economic shock of the last twenty years.

In 2003, there were roughly 1.9 million SMEs in Australia. By 2024, that number has grown to over 2.5 million.

What stands out here isn’t just the growth but the resilience. Look at the timeline. We lived through the Global Financial Crisis in 2008 and a global pandemic in 2020. One might expect to see massive craters in the business population during those periods. Instead the trajectory remains consistently upward.

A widening funnel means you don't have to compromise on quality just to get a deal done. When the TAM of targets is expanding, you can afford to be disciplined about your criteria by sticking to recurring revenue, healthy margins, and low capex because the volume of targets actually exists.

We aren't fighting over a shrinking pie. We are operating in a market where the inventory of potential acquisitions is deeper today than at any point in history.

Chart 2: The Silver Tsunami is No Longer Theoretical

The second chart shifts our focus from quantity to urgency. We’ve all heard the term Silver Tsunami, it’s been a talking point in white papers for a decade. But the data presented at the forum suggests we are no longer talking about a distant weather event. The rain is already hitting the roof.

Nearly 50% of Baby Boomer SME owners plan to retire in less than 5 years.

Let that sink in. Half of the baby boomer owners of established businesses in the economy are eyeing the exit and the clock is ticking loudly. But here is the statistic that creates the real opportunity, 2 in 3 of these owners lack a documented succession strategy.

This gap between the intent to retire and the preparation to do so is exactly where the search fund model shines.

We aren’t dealing with opportunistic sellers who are just testing the market to see if they can get a crazy multiple. These owners face a biological deadline and they have to sell to retire.

For passive investors this lack of planning is concerning. They see key person risk and run. For a searcher that risk is the entire point. You are the documented strategy. You are the solution to the problem that is keeping the owner awake at night.

When a seller has a hard timeline and no plan, the buyer who offers a clean exit and a safe pair of hands gains significant leverage. In addition to capital, you are offering legacy preservation, which can be worth more than a turn of EBITDA to a founder who cares about their employees.

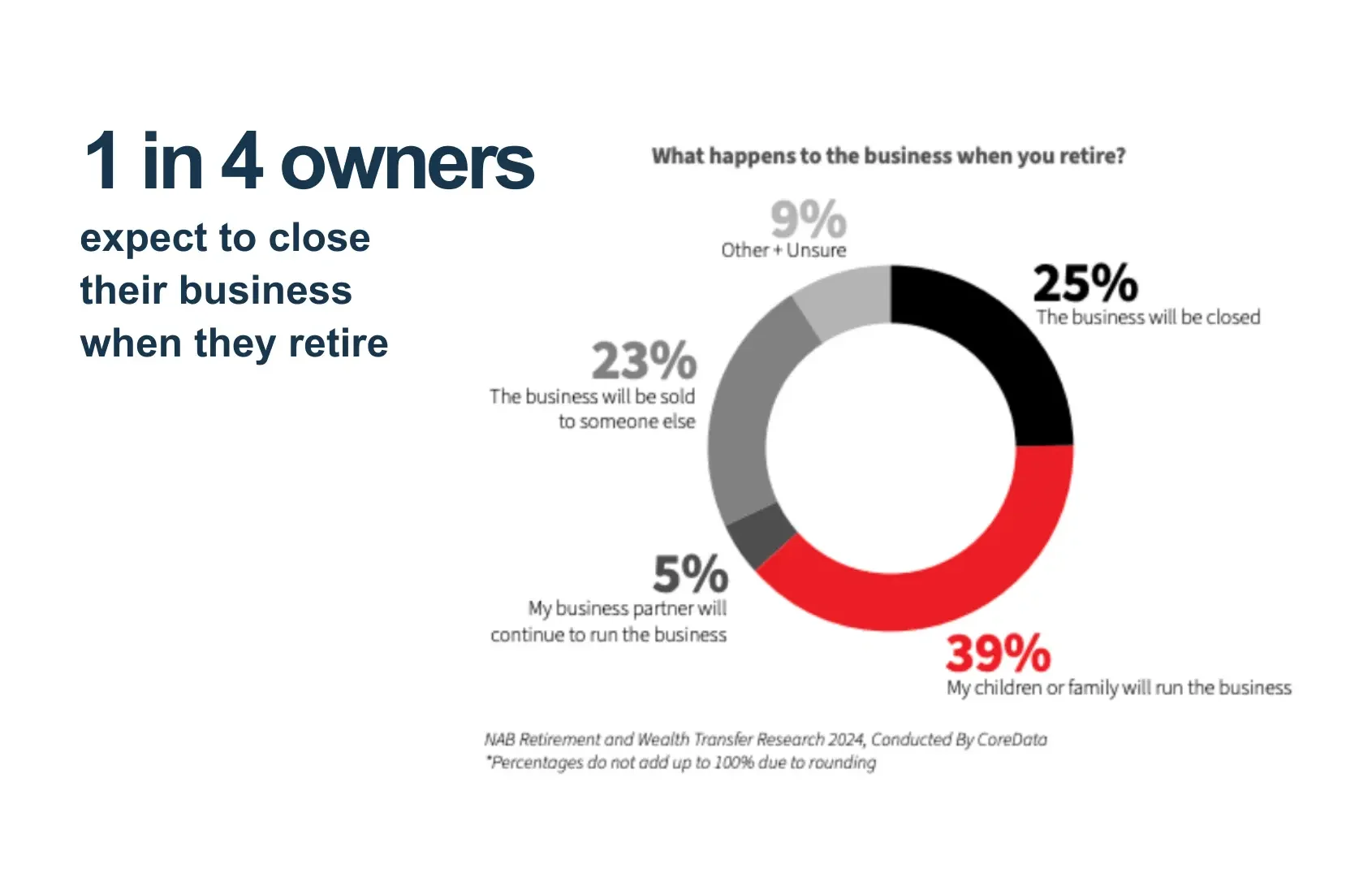

Chart 3: The Broken Exit Ramp

The third chart is where the challenge of the current market becomes visible. When NAB asked owners what happens to their life's work when they retire the answers revealed a broken exit ramp.

According to the data 25% of owners expect to simply close their business when they retire. Another 39% hope to pass it to children or family and only 23% expect to sell to a third party.

Think about the economic waste in that first number. To be clear, we are talking about profitable enterprises that simply turn off the lights because they lack a transfer mechanism. These are orphaned assets that are too small for PE and too complex for a trade sale, yet generating the cash flow that searchers hunt for.

The family succession slice of the pie is also more fragile than it looks. While nearly 40% of owners hope their children will take over, the reality is often different. The next generation frequently prefers corporate careers or tech startups over running the family HVAC or logistics company. That 39% creates a spillover effect of unplanned sellers hitting the market when Plan A falls through.

Why is the “sell to a third party” slice so small? It’s because the traditional capital stack has a missing middle.

Traditional private equity has a specific playbook. They hunt for scale, professional management teams, and businesses that can support high leverage. A founder-led business generating $2M or $3M in EBITDA usually fails their investment committee criteria. It’s too small for the big guys and too complex for the average financial buyer.

This is where the search fund wins.

That 25% of businesses destined to close isn’t filled with bad companies. It includes companies that lack a transition plan. These are the businesses that traditional PE ignores because they lack a bench of operators.

For a searcher that is a feature, not a bug. You are the bench. The structural gap in the market means you aren’t competing against sophisticated institutions. You are solving a problem that no one else is positioned to solve by preventing value destruction and stepping into a legacy that would otherwise vanish.

The Economic Reality: Why Multiples are Lower in ANZ

When you stack these three charts on top of each other the economic picture becomes clearer. We appear to have an oversupply of businesses, a large wave of forced sellers hitting a retirement cliff, and a structural lack of institutional buyers for these businesses.

It is a classic supply and demand imbalance. In any market when supply outstrips demand prices come down.

This dynamic explains the valuation gap we see today. Preliminary data collected for the ETA Forum shows that ANZ searchers are acquiring businesses at an average EBITDA multiple of 4.2x. Compare that to the US and Canada where mature search markets often see multiples north of 7x.

For a prospective searcher this gap is significant.

Buying a business at 4x EBITDA creates a built-in margin of safety. You don’t need to be a turnaround expert to make the math work at these entry prices. You don't need to bet on explosive venture-style growth. You just need to be a competent operator who can steward a profitable legacy. The lower cost basis protects you from early mistakes and offers significant upside if you can eventually sell into a more liquid market.

The Window is Open

The macro backdrop in Australia and New Zealand is structurally set up to reward the operator-led model. The supply of retiring baby boomers outstrips the capital available to buy them out.

For the talented operator this offers an alternative to the slow climb of the corporate ladder or the binary risk of a startup. Rather than competing in an oversaturated market you are stepping into a gap where professional leadership is often in short supply.

A capable operator can provide the succession solution that many owners are looking for.

However, markets are efficient and don’t leave structural gaps open for long. As the search fund model becomes better understood and more capital enters the space this dynamic may shift. The wave of retiring owners is substantial but it is still a finite event.

The data is clear that the opportunity for search funds in ANZ is real. As the model matures, this imbalance will inevitably correct. The question isn't whether the opportunity exists, but how long this window will remain open.