The Emerging ANZ Search Fund Opportunity

For years, the story of search funds Down Under was told mostly through anecdotes. With the release of our latest survey data presented by Jake Nicholson at the 2025 APAC ETA Forum, a clearer, data-backed picture is starting to emerge, and it confirms what many of us have suspected: a significant opportunity is quietly unfolding.

We're still early days, and with a growing but still modest dataset, we should treat these findings as preliminary signals, not final verdicts. Still, the initial data points to compelling trends in market momentum, search efficiency, and valuation that are worth a closer look:

Market momentum is accelerating as talented entrepreneurs choose this path.

Entrepreneurs in ANZ are searching more efficiently than their global peers.

Lower acquisition multiples appear to be creating a built-in margin of safety and significant upside potential.

Constraints are Easing, Momentum is Building

Every successful market has a flywheel, a self-perpetuating virtuous cycle. For years, the ETA flywheel in Australia and New Zealand struggled to get its first push, but as the early pioneers began successfully acquiring and operating businesses, they provided the validation the market needed. This success attracted a new wave of talent, which in turn drew in more capital, giving the flywheel the momentum it needs.

But launches are only part of the story, providing a leading indicator of search fund success in ANZ. The real test is whether these entrepreneurs can create value and realise that value for themselves and investors. We looked at the data for the 11 searchers in our survey who have concluded their search, and the early results are compelling. Eight have successfully acquired a business, giving the region an impressive initial acquisition rate of 72%.

Of the 11 completed searches, four entrepreneurs partnered with SMEVentures, and all four successfully acquired a business. For the remaining seven independent searchers, the success rate was 57% (4 out of 7).

That 57% figure should ring a bell for anyone familiar with the global data. It's the exact same acquisition rate reported in the 2024 Stanford Study for the highly mature US and Canadian markets over the last decade.

So, what does this suggest? It indicates that, when it comes to acquisition rates, independent searchers in ANZ are performing on par with their peers in the world's most developed ETA ecosystem. At the same time, we have to be honest about the numbers. The sample size is still small. While we believe this points to a healthy and robust market, the long-term trends will become clearer only as more searchers complete their journey.

How Quickly Are ANZ Searchers Acquiring?

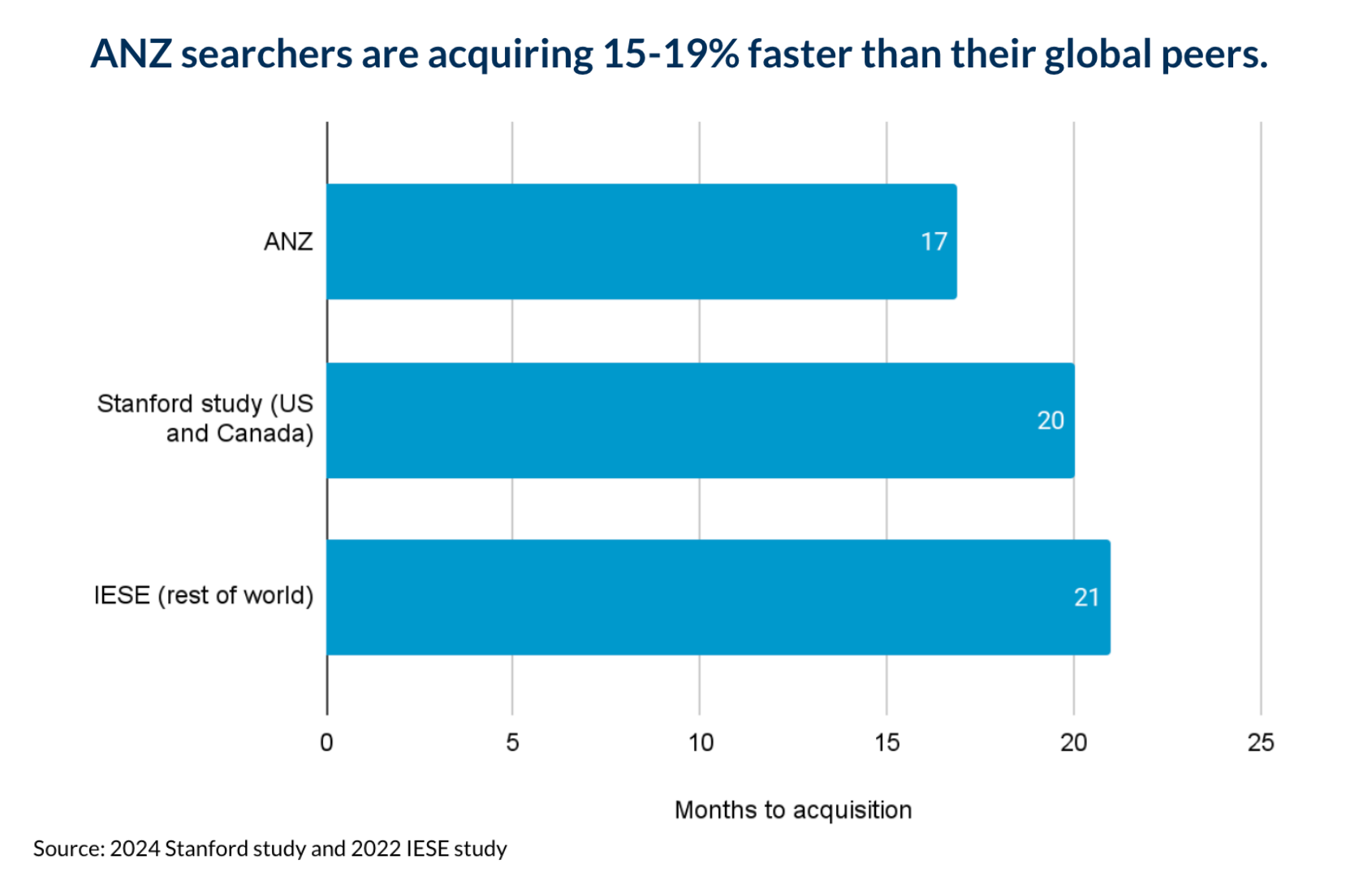

The data shows that ANZ searchers are acquiring businesses in an average of just 17 months. For comparison, the latest Stanford study clocks the average US/Canadian search at 20 months, while the IESE study puts the global (excluding US and Canada) average at 21 months. In short, local searchers appear to be closing deals 15-19% faster than their peers in more established markets.

Why does this matter? This velocity may signal a supply-demand imbalance of companies in the local market. A shorter time-to-close possibly suggest less competitive pressure from other buyers, allowing searchers to become the preferred partner. If true, this is the attractive dynamic for ETA. Less time spent competing for deals means entrepreneurs are more efficiently converting investor capital into acquisitions.

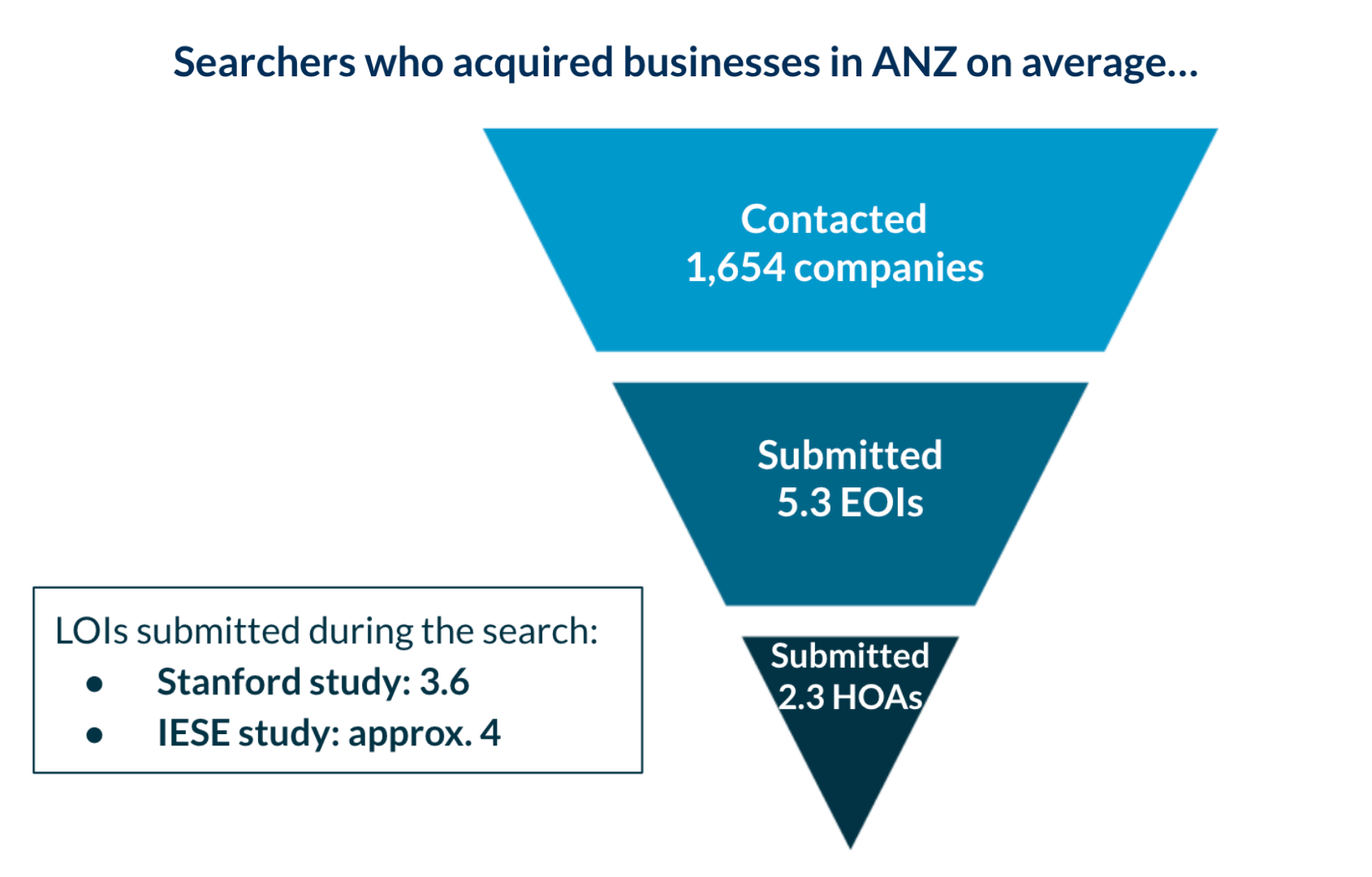

But speed isn’t everything. A fast search could just be a desperate one, and these metrics don’t yet capture the ultimate quality of the businesses being acquired. That's an important variable we can assess only over time. Still, to get a better sense of the quality of that speed, we can look at funnel efficiency. Here, the data is also telling. On average, an ANZ searcher submits 2.3 Heads of Agreement (HOAs)³ to get one deal done. For comparison, searchers in the US and Canada submit an average of 3.6 Letters of Intent (LOIs), while the IESE study average is roughly 4 LOIs per deal.

So, what’s the significance of needing fewer offers to close a deal? This high conversion rate points to several strategic hypotheses. Perhaps sellers in ANZ may be more committed once they engage, or it maybe that there is simply less competitive pressure from other buyers.

This dynamic allows the searcher's unique value proposition, a dedicated operator backed by capital, to make them the preferred buyer for great businesses at fair prices. It might also suggest that searchers are getting more effective guidance from their investors, leading to more robust offers and fewer broken deals. It could even be a cultural difference - perhaps US searchers are just more liberal about submitting LOIs on deals with a lower probability of closing. For now, we can't be definitive, but the early indicator is encouraging.

The Good News About Market Inefficiency

If you remember one number from this post, make it this one. Harvard Business School's Professor Rick Ruback, a leading expert on ETA, has a famous line. He says, "the magic is in the multiple." Search fund returns are built on acquiring solid businesses at reasonable prices. The global Stanford and IESE research confirms this pattern again and again.

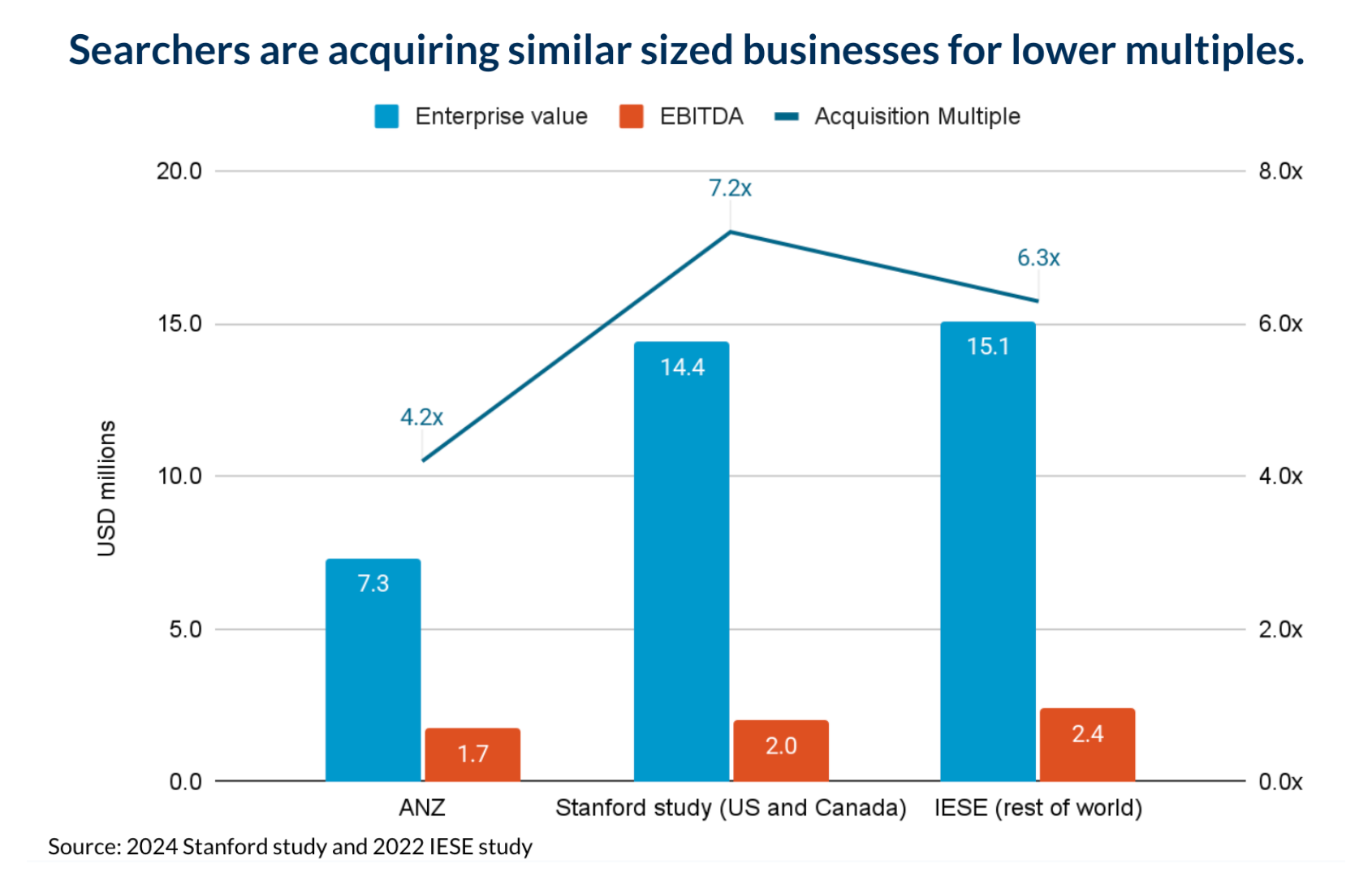

Across our dataset, ANZ searchers are acquiring businesses at an average EBITDA multiple of 4.2x.

Benchmarking this figure globally is complex, as it's not always an apples-to-apples comparison. The oft-cited 7.2x multiple in the US and Canada, for example, is skewed by a higher prevalence of software acquisitions. Those businesses are often valued on multiple of revenue metrics like ARR, not strictly on EBITDA, which can inflate the average when compared to a market like ANZ that is focused on more traditional service businesses.

So, what's behind this valuation gap? There are a few potential explanations, and we can't be definitive. First, we have to acknowledge that our data doesn't adjust for the relative quality of the businesses being acquired, which could certainly be a factor. Second, the lower multiples may signal a less efficient market where a searcher’s unique value proposition of pairing capital with a dedicated operator is highly valued by owners, allowing them to become the preferred buyer for great businesses.

While a combination of these factors is likely at play, the lower multiple is, on balance, another positive indicator for the region.

Whatever the precise cause, this valuation gap creates a powerful margin of safety. A first-time CEO can get up the learning curve and make the inevitable rookie mistakes without sinking the ship. The lower cost basis means the business doesn't need flawless execution to deliver strong returns, and it creates significant upside on exit, as the business can be sold into a more mature market, potentially capturing multiple expansion.

That margin of safety matters. When you're betting two years of your life on finding and buying one business, this valuation advantage may be one of the key drivers of your future success.

What We're Watching (and What We Don't Know Yet)

It’s worth repeating that the ANZ search fund ecosystem is still in its early days. The sample size for our survey is growing but modest. Our data tracks 11 completed searches and 12 that are still active. The recent metrics are promising, but they are also preliminary. As more data comes in, we'll get a clearer picture of whether these early patterns hold. We’ll be closely watching the continued influx of talent and whether valuations begin to compress as the market inevitably matures. The macroeconomic context, broader APAC search activity, and the evolving debt capital landscape are also critical factors that deserve their own analysis, which we'll tackle in future posts.

The data is incomplete, as with any nascent opportunity, but the fundamentals are compelling. Talented entrepreneurs are meeting favorable market dynamics, searchers are proving to be efficient, and valuations are creating a margin of safety. For anyone paying attention, including searchers and investors alike, the ANZ market is worth serious consideration.

—

Action Items

Challenge your assumptions. Go back through the metrics in this post and compare them to what you expected. Where did the data surprise you? What did you have wrong about the ANZ market?

Talk to people on the ground. Data tells you what is happening; conversations tell you why. Reach out to one or two people in the ecosystem, such as searchers, investors, or service providers. Ask them if these numbers match their reality.

¹The figure of 23 search funds is based solely on data collected from survey respondents within the ANZ Search Fund ecosystem held by SMEVentures. This number does not represent the entire universe of search fund entrepreneurs in Australia and New Zealand, as other operators may exist outside the survey data. The data should be interpreted as a strong indicator from a representative sample.

²Peter Kelly and Sara Heston, 2024 Search Fund Study: Research Overview, Case E-870, Stanford Graduate School of Business, June 28, 2024, p. 5.

³In the ANZ region, the term HOA (Heads of Agreement) is used for a non-binding offer that typically incorporates exclusivity and confidentiality provisions. This document is functionally equivalent to the LOI (Letter of Intent) common in the US and European search fund markets.